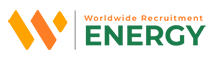

Most funding going towards reducing climate change is going towards climate mitigation, not climate adaptation. This means the world’s heading towards a point where natural disasters might prevail, and we have no way to adapt to them. Overall, this represents a great opportunity for companies and professionals to invest and develop adaptation solutions.

The climate adaptation market is expanding since it will impact almost every single industry. This means that by 2026, the market could be worth $2 trillion per year, yielding up to 7 trillion in net benefits. It is also worth mentioning that the average funding per project is $8 million, and private companies that take advantage of this could be launching or expanding their ventures.

Source: OECD in WEF

Climate finance provided and mobilized for adaptation amounted to $16.8 billion dollars in 2018. The amazing thing about this kind of financing is that private projects can benefit from public adaptation funds such as the GCF, the GEF, and the Adaptation Fund. A mandate was imposed on the former one since 2014 to deliver half of its portfolio to adaptation projects.

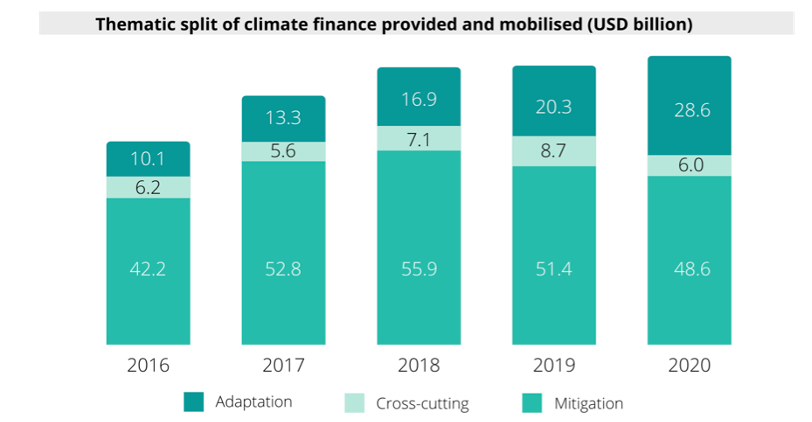

The renewables industry can be directly linked to climate adaptation, which makes it a perfect path for adaptation investments. In fact, many companies of different industries are increasingly concerned with protecting their operations from risks presented by climate change. The renewable energy sector can propel the flow of private finance into investment opportunities that address these concerns. In addition, climate adaptation financing through renewables can make projects more attractive for investors, as energy production yields more visible results than alternative projects.

Source: Revego in WEF

Entering Climate Adaptation Financing

To successfully enter the adaptation financing market, your venture will require talent that understands risks, finances, and their relationship more than anything else. You will also need a team that is able to link different industries with climate adaptation along with the solutions you provide with your venture or with partners. Furthermore, this trillion-dollar market will require a team with experience of working with both the private and the public sectors, as many of the projects end up being Private-Public Partnerships.

Additionally, your venture must have talent that understands the regions where your project will operate. You will need profiles that can do a great ESG analysis and that can understand the public policies and political climate. Innovative employees will also be indispensable, as many of the climate-adaptation financings require talent that understands diverse technologies such as solar irrigation or solar cooling.

A changing climate landscape is inevitable. As much as the renewables industry helps mitigate the risk, our future includes several climate-related disasters. Nonetheless, we have the opportunity to create the infrastructure that allows us to adapt. Is your company up for the challenge? And if so, do you have the right talent?